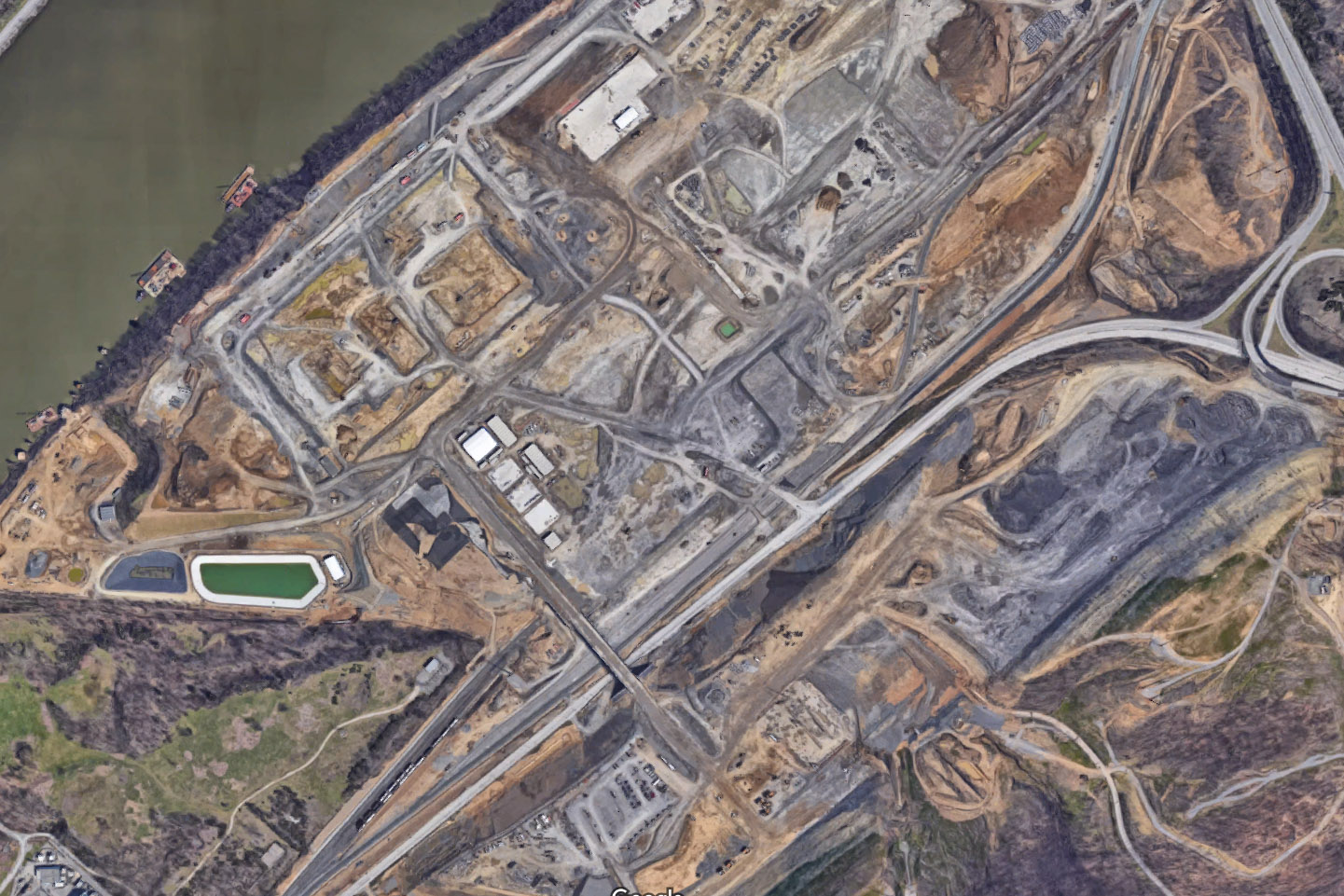

Shell is expected to begin constructing its $6-billion petrochemical plant in Beaver County later this year. But a new, state-commissioned report says that may be only the beginning for Pennsylvania’s petrochemical industry.

The report says the state will be producing enough of the right kinds of natural gas to support up to four ethane crackers in addition to Shell’s facility, which is slated to be online by 2021 or 2022.

LISTEN: The Coming Petrochemical Boom

The report predicts the state’s growing gas resources will spur up to $3.7 billion in investments into distributing and processing the type of natural gas used in creating plastics and chemicals.

“We have a tremendous opportunity in Pennsylvania to take advantage of that,” says Dennis Davin, Pennsylvania’s Secretary of Community and Economic Development. “There are opportunities for good, family-sustaining jobs.”

His department commissioned the report with funding from the public-private Team Pennsylvania Foundation, which focuses on growing the state’s economy. The report was prepared by the firm IHS Markit. It says the state’s gas industry will account for 40 percent of all natural gas in the country by 2030.

The report also predicts that by the years 2026-2030, the Marcellus and Utica shales in Pennsylvania, Ohio and West Virginia will produce a glut of natural gas liquids (NGLs), a class of drilling byproducts — like ethane and propane — that are used to make plastics and chemicals.

Gas will be so cheap in Pennsylvania that a plant producing plastic in the western part of the state “can compete well in both domestic and overseas markets” — especially Western Europe, the report says.

But that’s only if Pennsylvania takes aggressive action to attract companies that can build new crackers, the report says. It recommends speeding up the regulatory process for environmental and other permits, preparing more sites for construction and addressing a current shortage of pipelines.

Davin says the state is doing this by working to repair critical infrastructure like locks and dams, railroads and highways. It is also trying to train the local workforce to be able to work in the chemical industry.

“We’ve got to make sure we have the people they need,” he says.

Last year, Davin’s department received $75 million from the state legislature for a loan and grant program called “Business in Our Sites” through the Commonwealth Financing Authority. That program could help develop pad-ready sites for chemical plants and other manufacturers.

Of course, states can also offer tax breaks to attract big companies. Shell’s plant will receive more than $1.6 billion in tax breaks over 25 years from the state. The facility will employ 6,000 workers during the construction phase and 600 once complete.

The IHS report says economic incentives aren’t high on the list of reasons why a company might choose to locate in a state, but could be a “crucial tiebreaker” if a company is considering multiple states. Companies are currently considering building ethane crackers in Ohio and West Virginia.

Davin says the state would be open to offering tax incentives to other petrochemical companies that choose Pennsylvania. “Certainly we would not rule that out, and we would talk to companies that there are opportunities. But we’ll get to that point when we get to that point.”